I got an email from Equifax. I like to share the email here.

5 tips that can help improve your credit scores

1) Pay on time: One of the best things you can do to improve your credit scores is to pay your minimum payments on time, every time.

2) Keep your credit utilization rate low: It’s typically best to use 30 percent or less of the credit available to you on your revolving credit accounts, such as credit cards.

3) Limit applying for new accounts: Applying for new credit accounts will usually lead to a hard inquiry on your credit report. Sometimes these can negatively affect your credit scores for a short period of time.

4) Keep old accounts open: One of the factors in calculating credit scores is “average age of accounts,” so keeping paid-off accounts open can help maintain the length of your credit history, and help improve your credit scores.

5) Review your credit reports regularly: It’s important to check your credit reports regularly for any unpaid balances or past-due accounts, which can negatively impact your credit scores. You can also check for inaccuracies or signs of identity theft, such as credit accounts you didn’t apply for or a phone number that doesn’t belong to you.

I knew these tips except for “keep old accounts open”. I did cancel some credit card accounts because I don’t use it anymore.

I saw a poster from the Federal Reserve of USA Gov site. It has 5 tips for improving your credit score.

1) Get copies of your credit report – then make sure the information is correct.

2) Pay your bills on time.

3) Understand how your credit score is determined.

4) Learn the legal steps you must take to improve your credit report.

5) Beware of credit-repair scams.

Look, they are different from Equifax.

How to check your Credit score and get the Credit report for free?

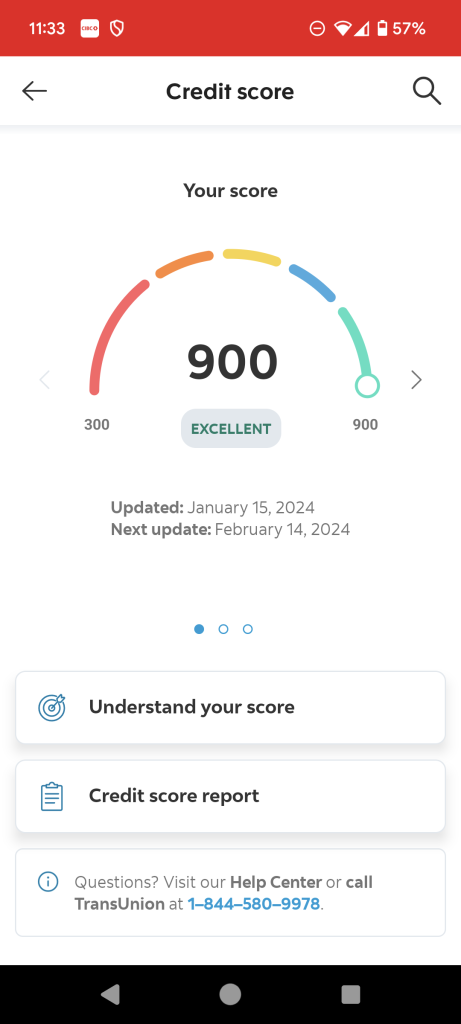

1) I have a Scotia Bank account. Within its App, I can check the TransUnion credit score for free.

My score is 900 today. If I click the Credit score report, I can see the details of the report. It includes all my accounts, open or closed. It shows the current balance, limit, and loan type of each account.

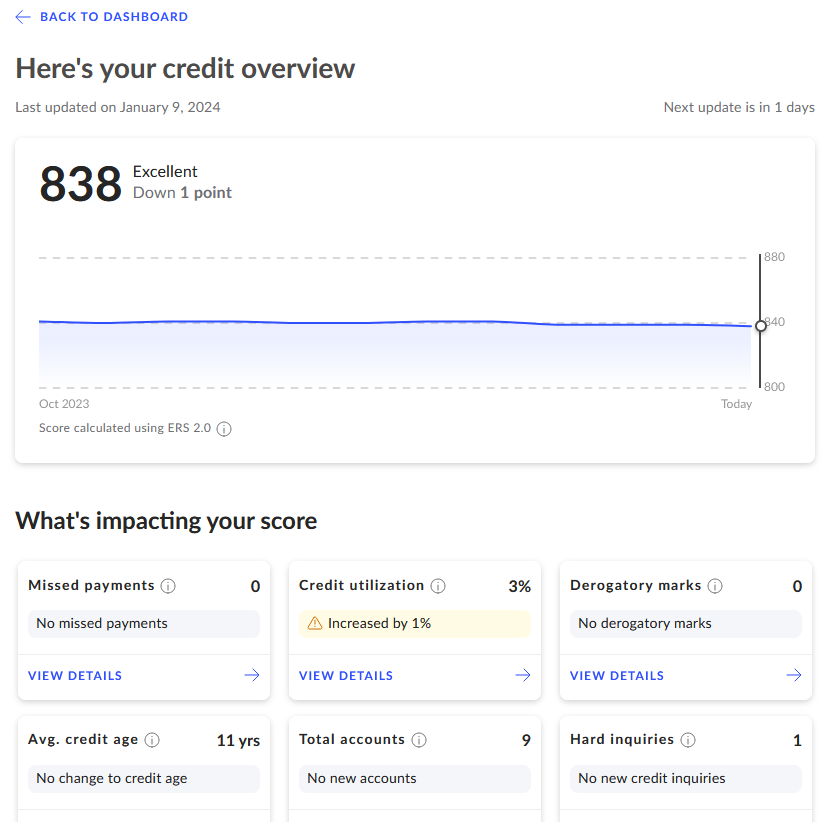

2) Borrowell Service

I registered the account on Borrowell.com. It has a credit score based on Equifax data.

My credit score here is 838. It is different because it uses different sources of data and the way of calculating.

I still have the excellent credit.