It is Tax Season again – Using Studio Tax

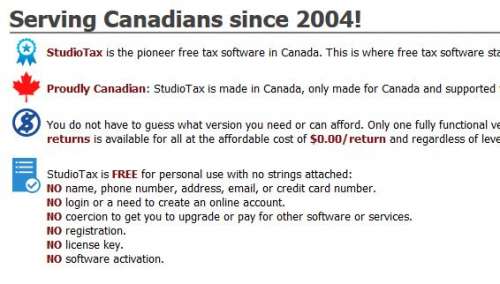

Every year we file our tax return to CRA. This year, I still recommend Studio Tax for the normal people. Normal people means, the people are not investor, not boss, not an officer. If your main income is from employment,...